Latest Headlines

Investors Purchase N2.61trn FG Bonds in Q1 2023 as Yield Fall Below Inflation Rate

Kayode Tokede

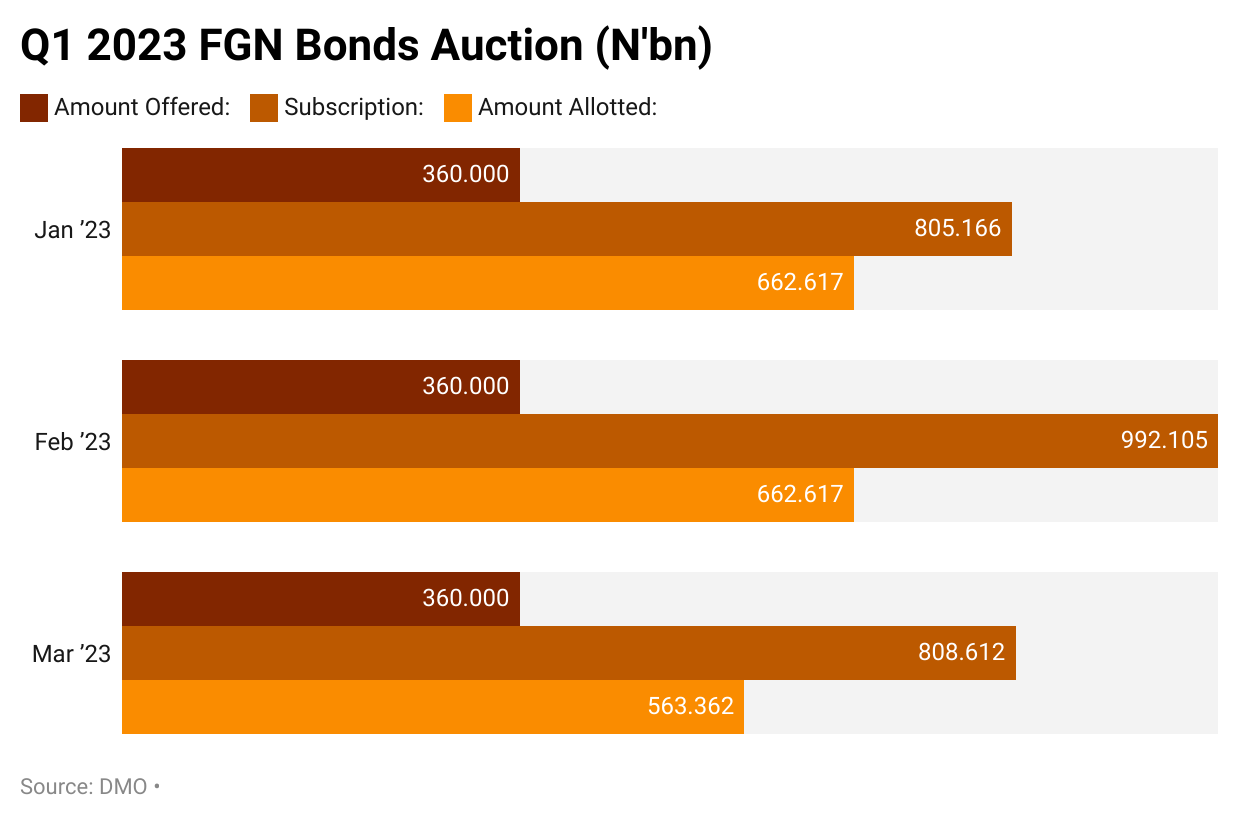

Domestic investors purchased N2.61trillion worth of FGN Bonds in the first quarter of (Q1) 2023 out of which N1.89 trillion was eventually allotted amid yield on 10-Year Bond falling below the inflation rate.

Latest statistics released by the Debt Management Office (DMO) revealed that a total sum of N1.08 trillion was the amount offered in the period under review as the federal government intensified borrowing from local investors to bridge budget deficit.

In Q1 2022, the DMO proposed to raise N450 billion but investors subscribed N1.16 trillion while the DMO eventually allotted a total of N882.49 billion.

The federal government had proposed to borrow over N11 trillion to finance the proposed 2023 budget deficit.

The Minister of Finance, Budget and National Planning, Zainab Ahmed had said the government’s budget deficit is expected to exceed N12.42 trillion if the government keeps the petroleum subsidy for the entire 2023 fiscal cycle.

She stated that N9.32 trillion in new borrowings, comprising N7.4 trillion from domestic sources and N1.8 trillion from foreign sources, adding that the government is expected to generate N206.1 billion from privatisation proceeds and N1.7 trillion in multilateral project-tied loans.

The N1.08 trillion bond proceeds is expected to be used to finance Nigeria, budget deficit, fund key infrastructure projects and stimulate economic development.

Findings by THISDAY revealed that 12 FGN Bonds auctioned were re-openings with rates below inflation rate.

The debt office in 2023 maintained four tenor bond auctions between January and March and each FGN bonds offer are oversubscribed.

Meanwhile, the latest auction result for the month of March witnessed a total subscription of N808.612 billion, about 44.5 per cent above the N360 billion offered- N563.36 billion was allotted.

The DMO on behalf of the federal government conducted an auction of FGN bonds on March 20, 2023 with a total of four offered to investors.

The four tenors auction was oversubscribed by domestic investors, indicating a strong demand for FGN Bonds amid the country’s macro economy headwinds and double-digit inflation.

The bond on offer were the 13.98 per cent FGN FEB 2028 (10-year), 12.50 per cent FGN APR 2032 (10-year), 16,25 per cent FGN APR 2037 (20-year) and 14.80 per cent FGN APR 2049 (30-year) with amounts at N90 billion for each tenor and totalling N360billion.

The bonds were sold at varying rates with marginal rates ranging from 14.000 per cent to 15.7500 per cent

The March auction recorded a subscription for the auction was N807.9billion, more than double the amount offered by 124 per cent.

The total amount allotted was N563.3 billion, with the highest subscription of N355.633 billion, going to the 20-year bond.

However, the highest allotment was N326.5billion going to the 30-year bond.

In February, the auction featured the re-opening of four bonds: the 13.98 per cent FGN FEB 2028 (10-year bond), 12.50 per cent FGN APR 2032 (10—year bond), 16.249 per cent FGN APR 2037 (20-year bond) and 14.80 per cent FGN APR 20049 (30-year bond).

The coupon rates for each bond was maintained with successful bids for the 13.98 per cent FGN FEB 2028 (1—year bond), 12.50 per cent FGN APR 20232 (10-year bond), 16.2499 per cent FGN APR 2037 (20-year bond) and 14.80 FGN APR 2049 (-year bond) being allotted at the marginal rates of 13.99 per cent, 14.90 per cent, 15.90 per cent and 16 per cent, respectively.

Analysts have attributed the strong demand for FGN bond to attractive yield, which offer investors’ high returns on their investments.

They added that the oversubscription also revealed that investors have confidence in the government ability to meet its debt obligations.

The appetite for FGN bonds indicates that Pension Funds Administrators (PFAs), and Nigerian investors prefer investment instruments with less volatility that assures them of their capital returns albeit with low yield on investment.

Responding to THISDAY enquiry on the matter, the Head, Equity Research, FBNQuest, Tunde Abidoye stated that bonds by federal government are oversubscribed over current liquidity surplus in the financial system, stressing that institutional investors continue to look for new avenues to invest funds from maturing securities, coupons and dividend receipts, and new AUMs generated.

According to him, “This is in addition to the fact that FG bonds are essentially risk-free. Notably, Nigerian pension funds are willing takers of FGN debt. Nigerian pension funds have historically favoured government debt as an asset class due to the paucity of good quality investible securities available to them. Other related reasons include the relative lack of depth of the equities market, portfolio safety considerations, and strict investment guidelines by the industry regulator.”

An economist and Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said the FG had notified the general public of borrowing more in 2023.

According to him, “With all the volatility and foreign exchange issues, it makes sense to borrow at the domestic market rather than borrowing from the international market. It is all a reflection of our macro economy environment challenges and weak fiscal policy of the government. All this borrowing also is a reflection of the weak financial position of the government and it will continue like that.”

He noted that the oversubscription to FGN bond is a lucrative investment, stressing that the low risk involved attracted investors.

He added, “Anything sovereign has the lowest risk and nothing will go wrong with it except the country is collapsing completely. All over the world, sovereign bonds have the lowest risk and secondly it is an investment outlet for investors to invest their money.”